The Future 50 is here

Meet 50 of the world’s highest-potential startups. Nominated by investors, selected by The Generalist.

“I really enjoy the thoughtfulness you put into your writing. There is so much noise in the tech world and I never regret opening your work.” — Lia, a paying member

Friends,

I am extremely excited to announce the 2025 edition of The Future 50, a database of the world’s highest potential startups valued at or under $200 million at the time of nomination. It’s the product of a five-month process involving over 200 elite venture practitioners, access to confidential information, and detailed independent research. Last year's Future 50 was our most popular launch, with several companies already raising at significantly higher valuations.

We created The Future 50 with a simple goal: to introduce readers of The Generalist to the most promising startups before they’re well-known.

Why do that?

We know that hearing about a breakout company early can serve as a real inflection point—for investors looking for their next big win, operators searching for a worthy place to apply their talents, and founders seeking inspiration.

To do that, we have obsessively worked on creating our version of an early detection system for great companies. It’s driven by investor nominations, careful research, exclusive data, and our editorial process.

Given the depth and exclusivity of this reporting, The Future 50 is available only to subscribers of our premium newsletter, Generalist+. For $22 per month or $220 per year, you’ll get total access to our database of breakout startups, accompanied by our detailed rationale and exclusive traction information. If you work in tech, venture capital, or traditional investing, this product alone should more than justify a year’s subscription.

What you can expect

By joining as a member and unlocking the full Future 50, here’s what you can expect:

Detailed company profiles with clear explanations of what each does and why it matters

Exclusive traction data, including customer wins, revenue signals, and growth metrics

Three-point rationales explaining exactly why each company made the cut

A searchable database to filter by geography, sector, or team size

Join us now to unlock the full database and learn about 50 of the world’s highest-potential startups.

Takeaways

Key themes

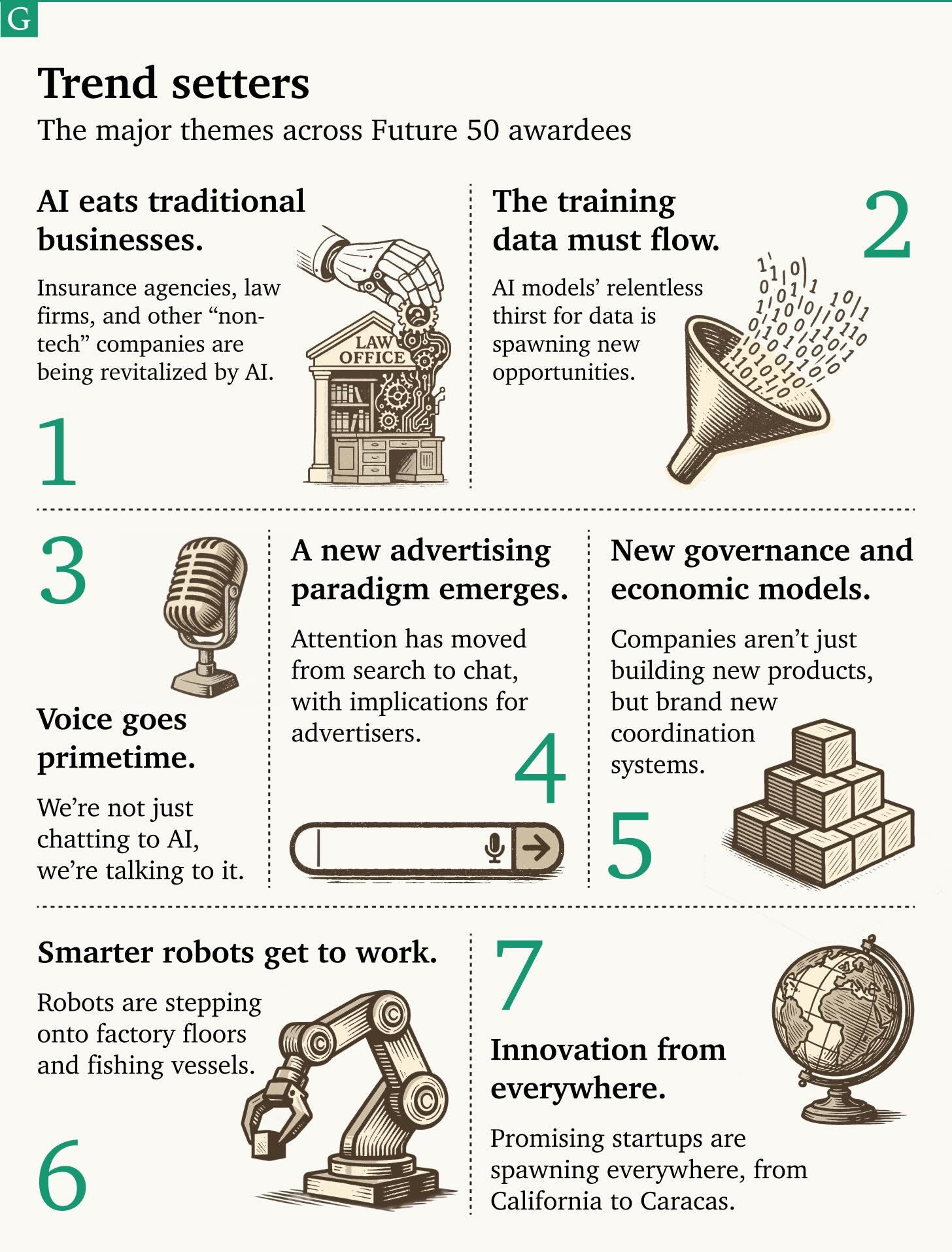

Though there is incredible variety among the awardees, a few key themes came to the fore. Pay attention to AI’s impact on traditional businesses, the unslakeable thirst for data, creative governance models, and much more.

Innovation from everywhere

As was the case last year, we discovered great companies worldwide. While America remains the undoubted epicenter of high-growth startups, we found exceptional teams operating in 12 different countries. We have awardees building incredible AI businesses in Brazil, high-performance drone systems in India, and elegant product software in Australia.

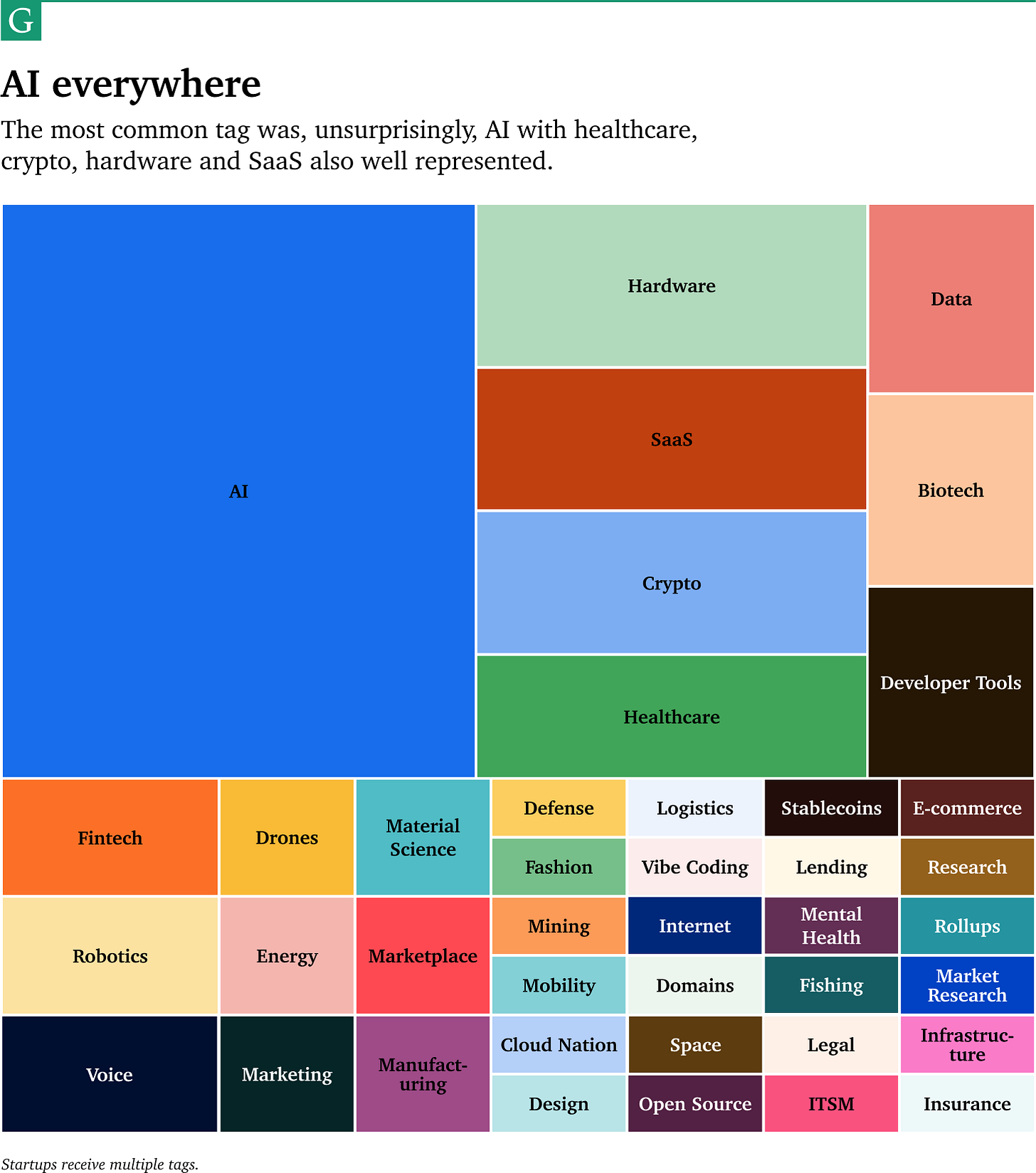

The most common sector? AI.

As you might expect, AI was everywhere from healthcare to defense to biotech to crypto to fashion. There’s no doubt that talented entrepreneurs are finding effective, original ways to leverage the technology to create net-new experiences, revitalize traditional industries, and unlock thorny problems.

B2B > B2C

Nearly 75% of awardees operate B2B, while 18% are B2C. Despite that, the Future 50 includes intriguing new consumer experiences that might change how we shop, spend, and connect with AI companions.

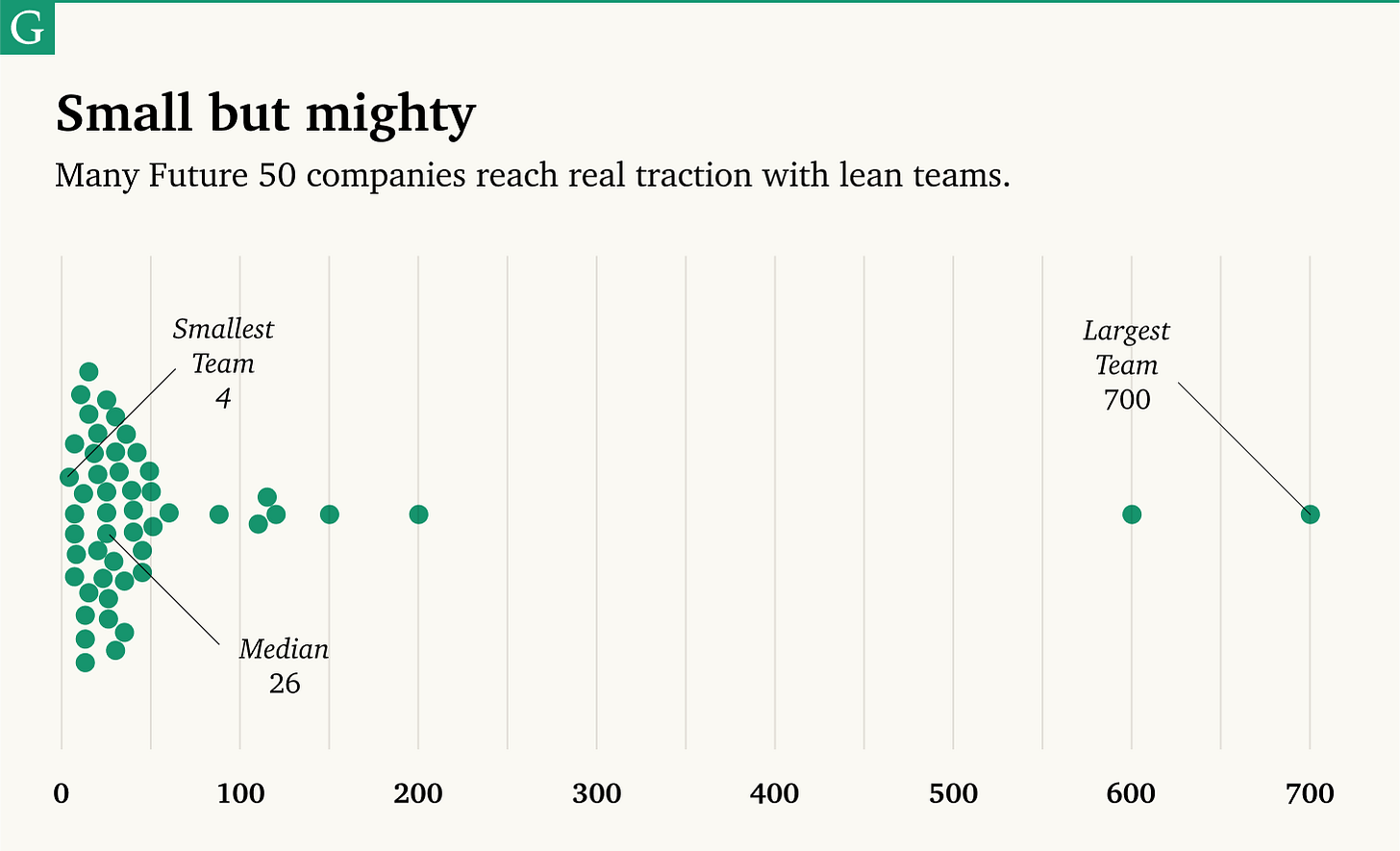

Lean teams

Though there were some outliers, most awardees operate with fewer than 50 full-time employees. While this is not entirely unusual given how young many of the startups are, it’s still striking to see how much traction companies can achieve with lean teams.

On the other end of the spectrum, a few startups have built large operations but still have valuations under our threshold. That’s an indication of the differing labor costs around the world and how strong unit economics can allow a company to fund its own growth.

This is just the start! There is much more to discover in the full piece and database.

Our process

There are an infinite number of ways you might try to create a list like this one. You could collate it based on perceived status, hard metrics, personal opinion, or the opinion of ceremonial judges. We took a different approach, with a few key characteristics:

Create a valuation threshold. We started by setting a valuation threshold of $200 million, post-money, at the time of nomination. (Naturally, some companies have raised in the five months since.) It is hard enough to compare a biotech firm to a social media app – it only becomes more so when one is a seed company and the other a Series D scale-up. The $200 million threshold prioritizes companies with real traction and strong products in market, but that still have plenty of room to run.

Focus on nominator quality, not quantity. We chose an outbound approach, believing it allowed us to create the highest quality list. We contacted over 200 of the world’s best-regarded investors and asked them to nominate companies with the highest potential. We started with those we know and consider exceptional pickers. In turn, we asked them to nominate other investors they consider impressive. We only considered nominations from partner-level investors and a few select angels with exceptional taste. Overall, investors from nearly every Tier 1 fund participated.

Push to the edges. We believe many of the most impactful companies will be built outside the United States. We proactively sought elite venture investors from Latin America, Africa, Europe, Oceania, and Asia to ensure global coverage. As you’ll discover, the list includes many stellar organizations from beyond Silicon Valley.

Force stack ranking to avoid over-nominating. As noted, we asked every investor to nominate the two companies they considered particularly high-potential, with an explanation for each. (Some investors ended up sharing a few more, which we considered.) Ultimately, our goal was not to solicit as many nominations as possible but to encourage nominators to make difficult choices, selecting those they consider the very best of the best. As a note, I did not nominate any companies myself to avoid a conflict of interest.

Study each company. After receiving an extremely strong cadre of nominations, I personally reviewed each one. This involved reading the investors’ rationales and studying the company directly via its website and associated press. We used this to filter the list down to a group of finalists.

Request exclusive, confirmatory information. We contacted the finalists directly and asked them to share data confirming their valuation at the time of the nomination, cumulative capital raised, and revenue run rate. We also asked them to outline their primary sources of differentiation and highlight other traction they consider notable. Companies have allowed some of this data to be shared publicly for the first time; the rest remains confidential but was invaluable in our assessments.

Make final judgments. We used the information gleaned from companies to choose our final 50. This relied on me personally reviewing all additional data supplied by the companies. In making our choice, we factored in metrics but also recognized that great companies have different commercial maturation rates.

Provide detailed descriptions and clear rationales. One of our frustrations with lists is that they are often light on detail. For each awardee of the Future 50, you will find a strong synopsis of the business and why it matters. You will also find a bullet-pointed rationale explaining its inclusion: what we liked about it and why.

No process is perfect, and there are certainly trade-offs to any approach. However, this process has enabled us to create something unique: a global, detailed, actionable list of potentially legendary companies, many of which I had never heard of before.

Join today to access the full database. As with last year's cohort, we expect these valuations won't stay under $200M for long.

Brought to you by Brex

Brex is proud to sponsor The Generalist’s Future 50—a list of bold companies building what’s next. At Brex, we believe founders should be focused on creating the future, not drowning in spreadsheets and clunky finance tools. That’s why we built a finance platform that’s simple, scalable, and fast.

With Brex, founders get everything they need to maximize runway and grow their businesses—corporate cards, startup-friendly rewards, banking, and high-yield treasury with same-hour liquidity—all in one place. Over 30,000 companies, including 1 in 3 U.S. venture-backed startups, trust Brex to help them spend smarter and move faster. Ready to join them?

The Future 50

Meet 50 of the world’s highest-potential startups. Nominated by investors, selected by The Generalist.