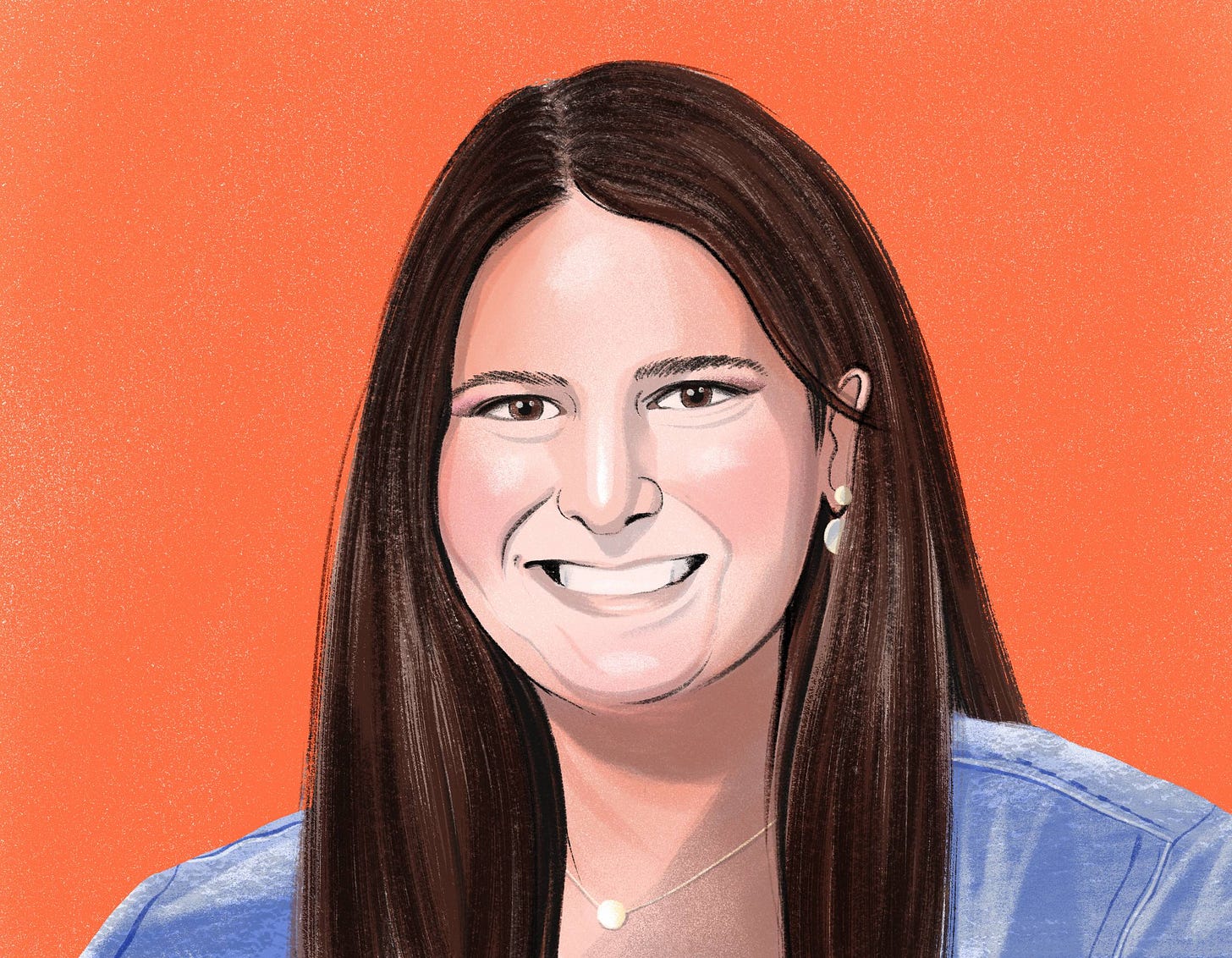

Modern Meditations: Rebecca Kaden

The Union Square Ventures managing partner on stories, ancient structures, and technological salvation.

Brought to you by Masterworks

A Banksy got everyday investors 32% returns?

We know it may sound too good to be true. But thousands of investors have profited, thanks to the fine-art investing platform Masterworks.

That Banksy return isn’t a one-off. Masterworks has built a track record of 16 exits, including net returns of +10…